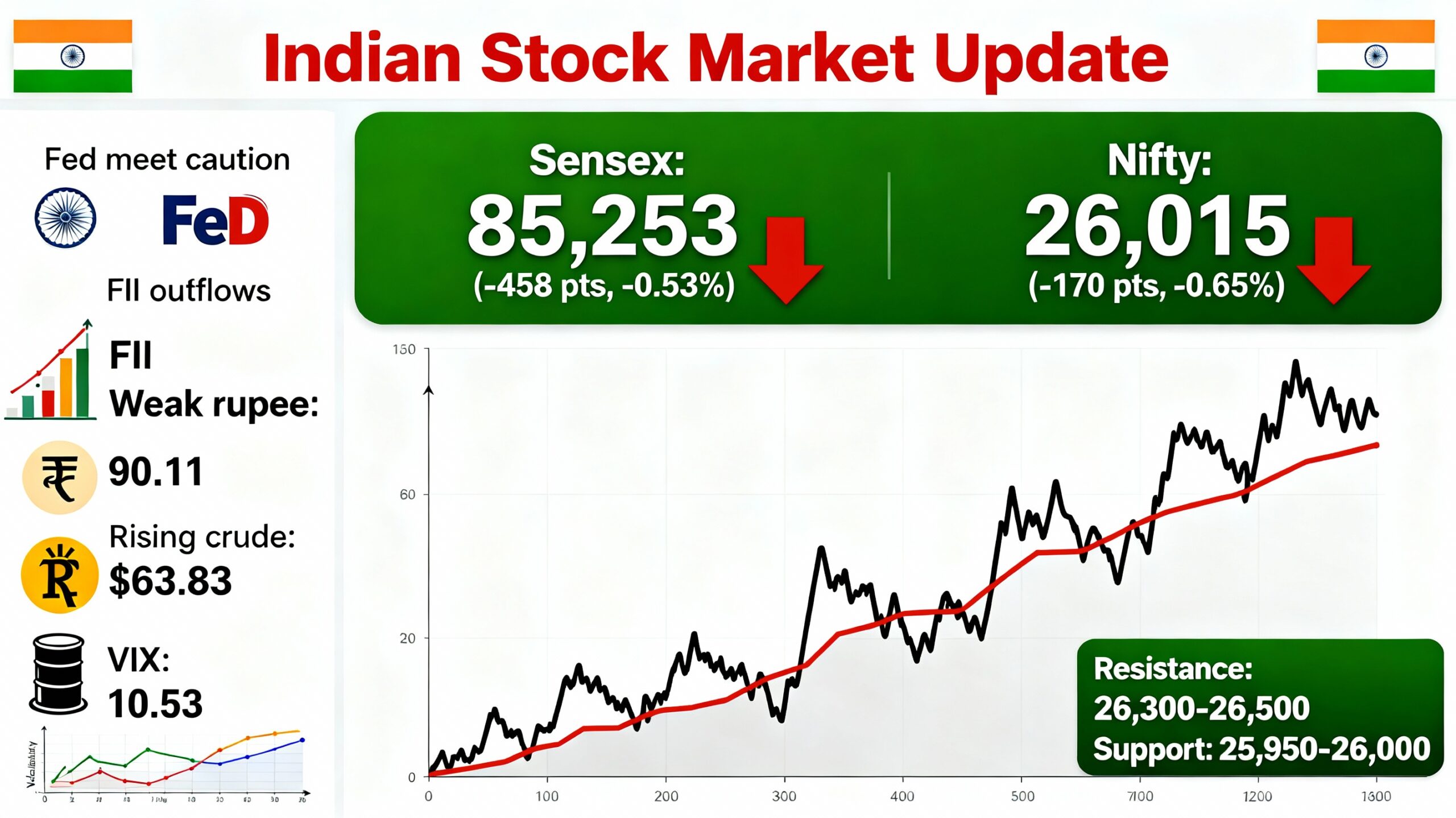

Stock Market Today: Sensex slips 450 pts, Nifty below 26,050: Caution ahead of Fed meet among key factors behind market decline

The equity benchmark indices declined on Monday as investors booked profits in select sectors and foreign fund outflows continued ahead of the US Federal Reserve’s policy meeting.

At around 12:30 p.m., the Sensex fell 458.52 points, or 0.53 percent, to 85,253.85, while the broader Nifty declined to 26,015.65, down 170.80 points, or 0.65 percent.

InterGlobe Aviation, Bharat Electronics, and ETERNAL were among the major laggards in the Nifty50 pack, declining up to 7 percent, while HDFC Life Insurance Company and Tech Mahindra were among the major gainers, rising up to 1 percent. Market breadth remained negative as about 1174 shares advanced, 2418 shares declined, and 201 shares were unchanged.

Key factors behind market decline 1) Caution ahead of US Fed meet: The investors stayed on the sidelines ahead of the Fed’s two-day meeting beginning December 9.

“Investors positioned cautiously ahead of the upcoming FOMC meeting, additional inflation releases, and year-end portfolio adjustments,” said Devarsh Vakil, Head of Prime Research, HDFC Securities. He added that central banks in Australia, Brazil, Canada, and Switzerland are also scheduled to meet this week, though no policy changes are expected outside the Fed.

2) Persistent FII outflows: Foreign institutional investors extended their selling streak, offloading equities worth Rs 438.90 crore on Friday—the seventh straight session of net outflows.

3) Weak rupee: The rupee weakened 16 paise to 90.11 against the US dollar in early trade, weighed down by higher crude prices and continued foreign fund withdrawals. The local currency opened at 90.07 before easing further on strong dollar demand from corporates, importers, and overseas portfolio investors, forex dealers said.

4) Crude rises: Brent crude, the global oil benchmark, inched up 0.13 percent to USD 63.83 per barrel. Higher crude prices tend to pressure India’s import bill and fuel inflation concerns, often prompting cautious sentiment in the equity market.

5) India VIX rises: India VIX, the volatility index, rose 2.11 percent to 10.53. A higher VIX indicates increased market uncertainty, which typically leads traders to reduce risk exposure.

Technical Analysis Vakil said the Nifty regained its upward momentum after moving above its near-term resistance at 26,100 on Friday. “Immediate resistance is now seen around 26,300, followed by 26,500, while on the downside, the 25,950–26,000 band is expected to act as a crucial support zone,” he added.