`Plunge: Understanding the ₹12 Lakh Crore Market Shakeup

Sensex Plummet: Exploring the Factors Behind the Market Turmoil The recent plummet in the Sensex…

The upcoming week (March 9–13, 2026) is shaping up to be a busy one for Indian equity investors. Whether you are looking for passive income through dividends or increased liquidity via stock splits, several big names—including IRFC and SBI Cards—are hitting key corporate action dates. High-Value Dividends Axtel Industries leads the pack with a significant…

The markets woke up to a sea of green in the commodities section this Monday, but the reason behind it is anything but peaceful. As Middle East tensions escalate into a direct confrontation, gold and silver have ceased to be just “investments”—they have become the ultimate survival shields for global capital. The “Safe-Haven” Surge in…

History has a strange way of repeating itself, especially on Dalal Street. While headlines scream “Crisis in Iran,” seasoned investors are looking at a different set of numbers. The Irony of the “War Bounce”: It feels counter-intuitive. How can the Nifty 50 or Sensex rise when global stability is at stake? The answer lies in…

A routine request to close a bank account has unraveled one of the most significant banking frauds in recent months. IDFC First Bank recently disclosed a ₹590 crore discrepancy in accounts belonging to the Haryana Government at its Chandigarh branch. The Red Flag: The issue came to light on February 18, 2026, when a Haryana…

Gold prices witnessed a slight correction on Monday, February 16, 2026, as futures trading on the Multi Commodity Exchange (MCX) saw a drop of ₹589. The yellow metal for April delivery settled at ₹155,306 per 10 grams, marking a 0.38% decrease. What’s Driving the Slide? The primary catalyst for this dip is a bearish trend…

The logistics sector is often seen as the heartbeat of global trade, and Tiger Logistics (India) Limited (BSE: 536264) just proved why resilience and agility are the most valuable currencies in today’s market. Despite a complex global landscape marked by normalizing freight rates and geopolitical tensions in the Middle East, Tiger Logistics has reported a…

Introduction: Are you one of the many waiting for the perfect moment to invest in gold or finally buy that exquisite piece of jewelry? Well, the wait might be over! Gold prices have seen a significant drop today, offering a golden opportunity for buyers and investors alike. Let’s dive into the details of today’s gold…

The gold market has just delivered a masterclass in volatility. While the Economic Survey 2025-26 recently highlighted gold’s staggering 116% return over the past year, the market immediately countered with a “Metals Massacre.” On Friday, January 30, 2026, spot gold on the MCX plunged 4.87% to ₹167,095, while silver and major gold ETFs like Axis…

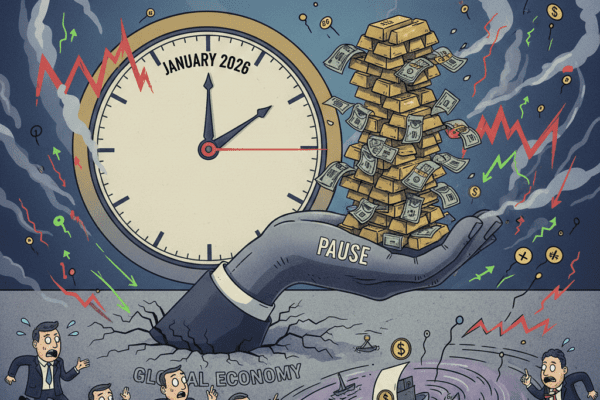

The first FOMC meeting of 2026 (Jan 27-28) is nearly here, and the “higher for longer” ghost is back. While a rate pause is 97% priced in, the real story isn’t the decision—it’s the danger of standing still. Here is your data-driven preview of why this “pause” might be more volatile than a “pivot.” 📊…

🎯 The Bold Vision When India and Australia signed the Economic Cooperation and Trade Agreement (ECTA) on April 2, 2022, they set an audacious target: bilateral trade worth AUD 100 billion by 2030. As we enter 2026, the partnership is accelerating—but is the $100 billion dream realistic? 📊 The Numbers That Matter Current Trade Snapshot…