External Review Expected to Conclude by Q4 FY25

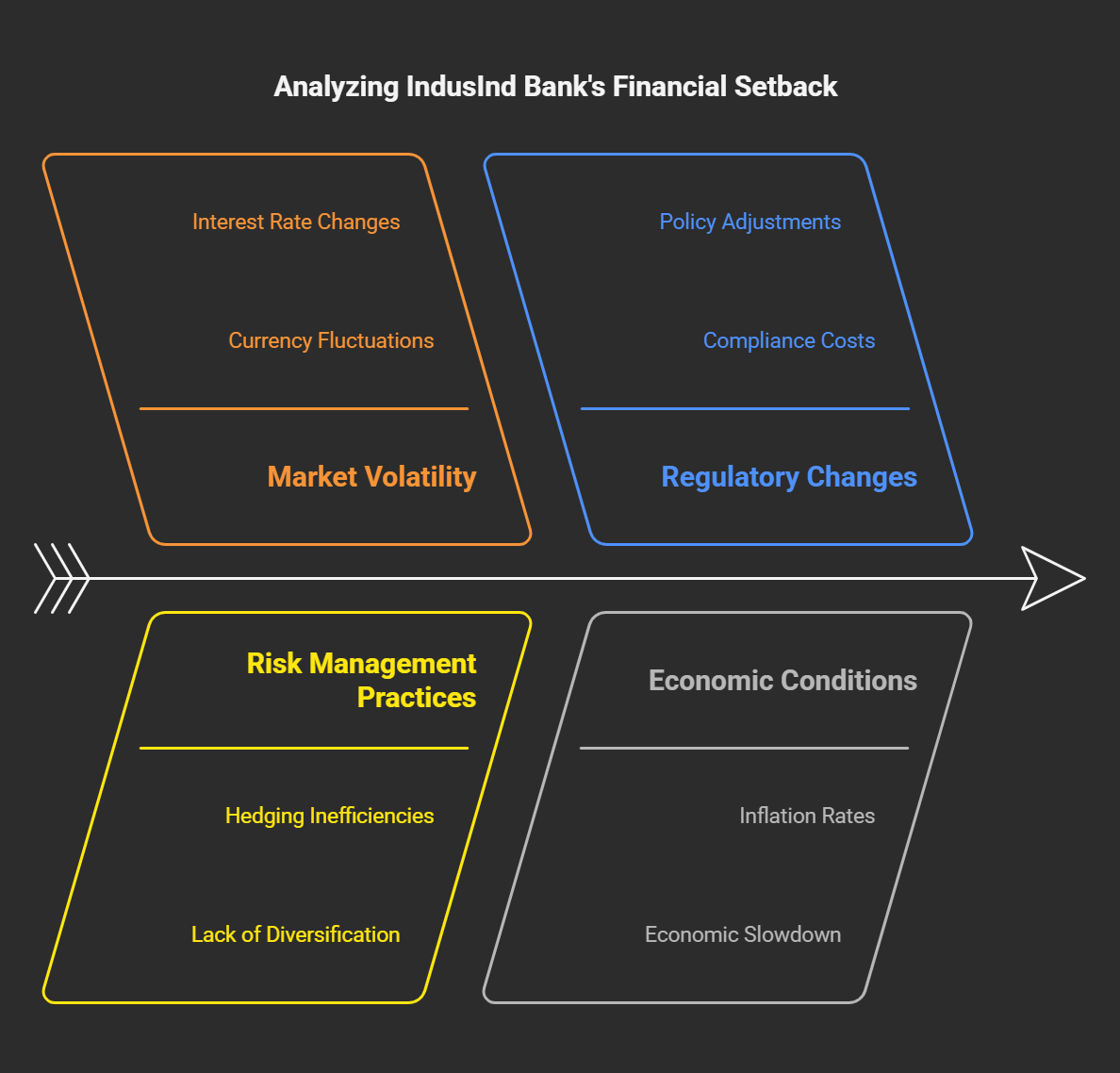

IndusInd Bank, one of India’s leading private sector lenders, has warned of a potential loss of Rs 1,500 crore due to adjustments in its derivatives portfolio. This impact, estimated at 2.35% of the bank’s net worth as of December FY25, stems from hedging instruments used to manage foreign currency exposure related to international deposits and borrowings.

Derivative Portfolio Adjustments Could Affect Profitability

During an analyst call, IndusInd Bank’s Chief Executive and Managing Director, Sumant Kathpalia, confirmed that the anticipated loss would need to be accounted for in the profit and loss (P&L) statement, as general reserves cannot be utilized to offset the impact. He further explained that the bank’s balance sheet management desk, which also oversees asset-liability mismatch (ALM) management, is responsible for handling these hedging instruments.

Internal Review Identifies Discrepancies

On March 10, IndusInd Bank disclosed in a filing that an internal review of its derivative portfolio uncovered a potential financial impact. As of March 31, 2024, the bank’s net worth stood at approximately Rs 62,000 crore. The review was prompted by the Reserve Bank of India’s (RBI) guidelines issued in September 2023 concerning the investment portfolio of lenders, specifically addressing ‘Other Asset and Other Liability’ accounts.

While the bank acknowledged discrepancies in these account balances, it did not disclose the specific methodology used to identify them during its investor call.

Independent External Review Underway

To ensure transparency, IndusInd Bank has engaged a reputed external agency to independently verify its internal findings. Although the final report is pending, the bank has assured investors that its profitability and capital adequacy remain robust enough to absorb this one-time loss.

Future Strategy: Hedging with External Counterparties

Kathpalia stated that the external agency’s review should conclude by the fourth quarter of the current financial year. Moving forward, the bank has decided to execute trades exclusively with external market counterparties to hedge its balance sheet.

“We now only engage in external trades with market counterparties to hedge our entire balance sheet,” IndusInd Bank’s management confirmed during the analyst call.

Additionally, effective April 1, the bank has completely ceased internal trades. Any previous internal trades have been unwound in accordance with mark-to-market valuations.

Market Reaction and Stock Performance

Following the announcement, IndusInd Bank’s stock experienced a sharp decline of 4%, closing at Rs 900.50 on the NSE. Over the past month, the stock has shed nearly 16% of its value.

A spokesperson for IndusInd Bank did not immediately respond to requests for comment. This article will be updated as more information becomes available.