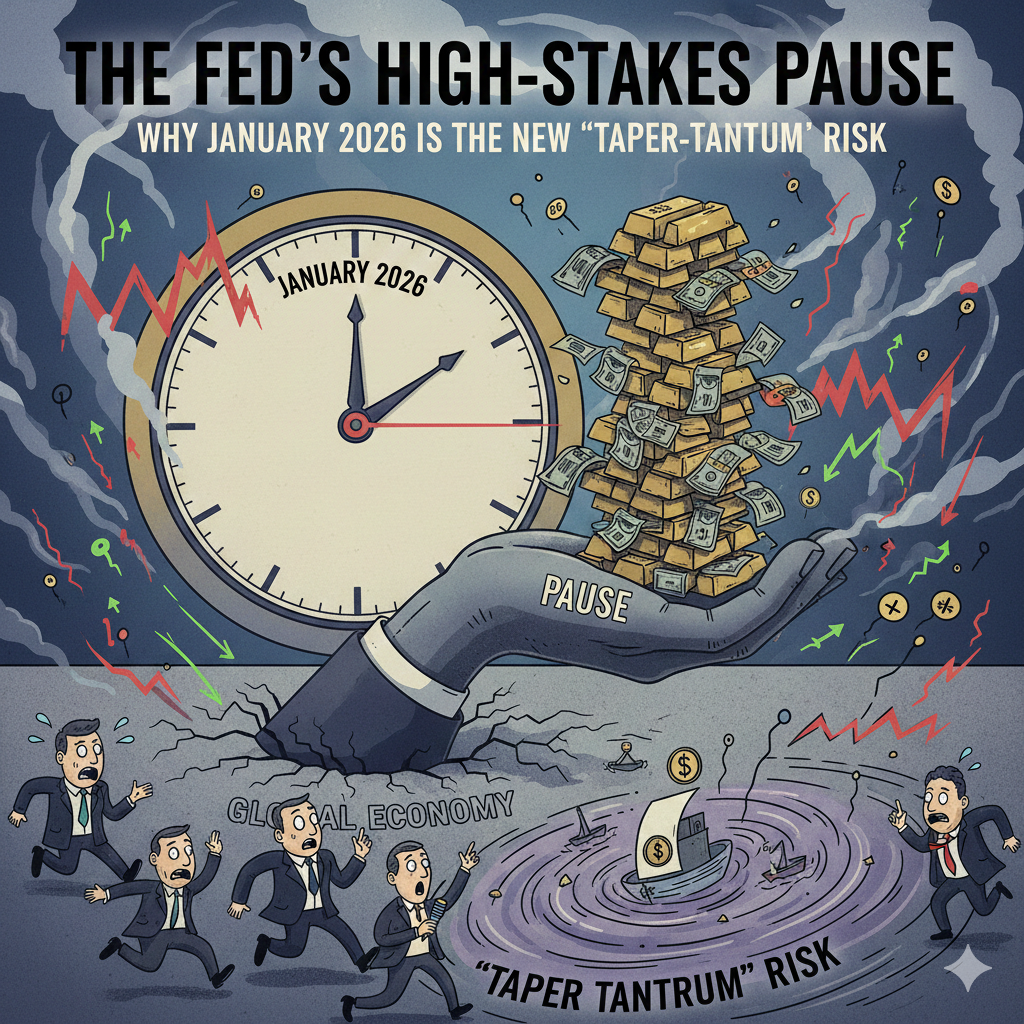

The first FOMC meeting of 2026 (Jan 27-28) is nearly here, and the “higher for longer” ghost is back. While a rate pause is 97% priced in, the real story isn’t the decision—it’s the danger of standing still.

Here is your data-driven preview of why this “pause” might be more volatile than a “pivot.”

📊 The Numbers the Fed is Obsessing Over

- Inflation’s Sticky Floor: December’s CPI came in at 2.7% YoY. While down from the peaks of ’24, progress has stalled. Core CPI is holding at 2.6%, suggesting that the “last mile” to the 2.0% target is more of a marathon than a sprint.

- The Labor Paradox: Unemployment actually ticked down to 4.4% in December. This gives Chair Powell the “data cover” to stay hawkish. If the labor market isn’t breaking, why cut further?

- Market Odds: The CME FedWatch Tool shows a 97.2% probability of a hold at the current 3.50% – 3.75% range.

⚠️ The 3 Biggest “Pause” Risks

1. The “K-Shaped” Divergence Consumer confidence hit a 12-year low in January, even though the S&P 500 is hitting record highs. The risk? By pausing now to fight 2.7% inflation, the Fed might ignore the “lower spur” of the economy—the 40% of Americans struggling with debt and stagnant wages—until it’s too late.

2. The 2026 Dot Plot Rift The latest “dot plot” suggests only one more cut for all of 2026. Markets were hoping for three. If Powell’s press conference confirms a “hawkish hold,” expect a sharp correction in the bond market as yields repricing for a much tighter 2026.

3. The Independence Factor With Powell’s term nearing its end and headlines dominated by political inquiries, the Fed is under immense pressure to prove its independence. A pause isn’t just about math; it’s a signal that the Fed won’t be bullied into premature cuts by the administration.

💡 The Strategy: What Should You Do?

- Cash is (Still) King: With rates holding near 3.75%, short-term Treasuries and high-yield money markets remain a low-risk “waiting room” for capital.

- Watch the Wage Growth: If the February jobs report shows wage cooling, the March meeting (currently a coin toss) becomes the new “live” event.

- Equities Resilience: Look for companies with strong balance sheets that aren’t reliant on cheap refinancing—the “pause” means the cost of capital isn’t coming down anytime soon.

🗨️ What’s your take? Is the Fed right to pause and wait for the “cleaner” data, or are they repeating the 2021 mistake of being “behind the curve”?

Let’s discuss in the comments. 👇