The U.S. Federal Reserve’s policy outcome, due tonight around 11:30 PM (IST), will play a crucial role in setting the direction for global and Indian equity markets. With analysts widely expecting a rate cut amid signs of a cooling U.S. labor market, here’s a look at how different scenarios could shape Indian market sentiment.

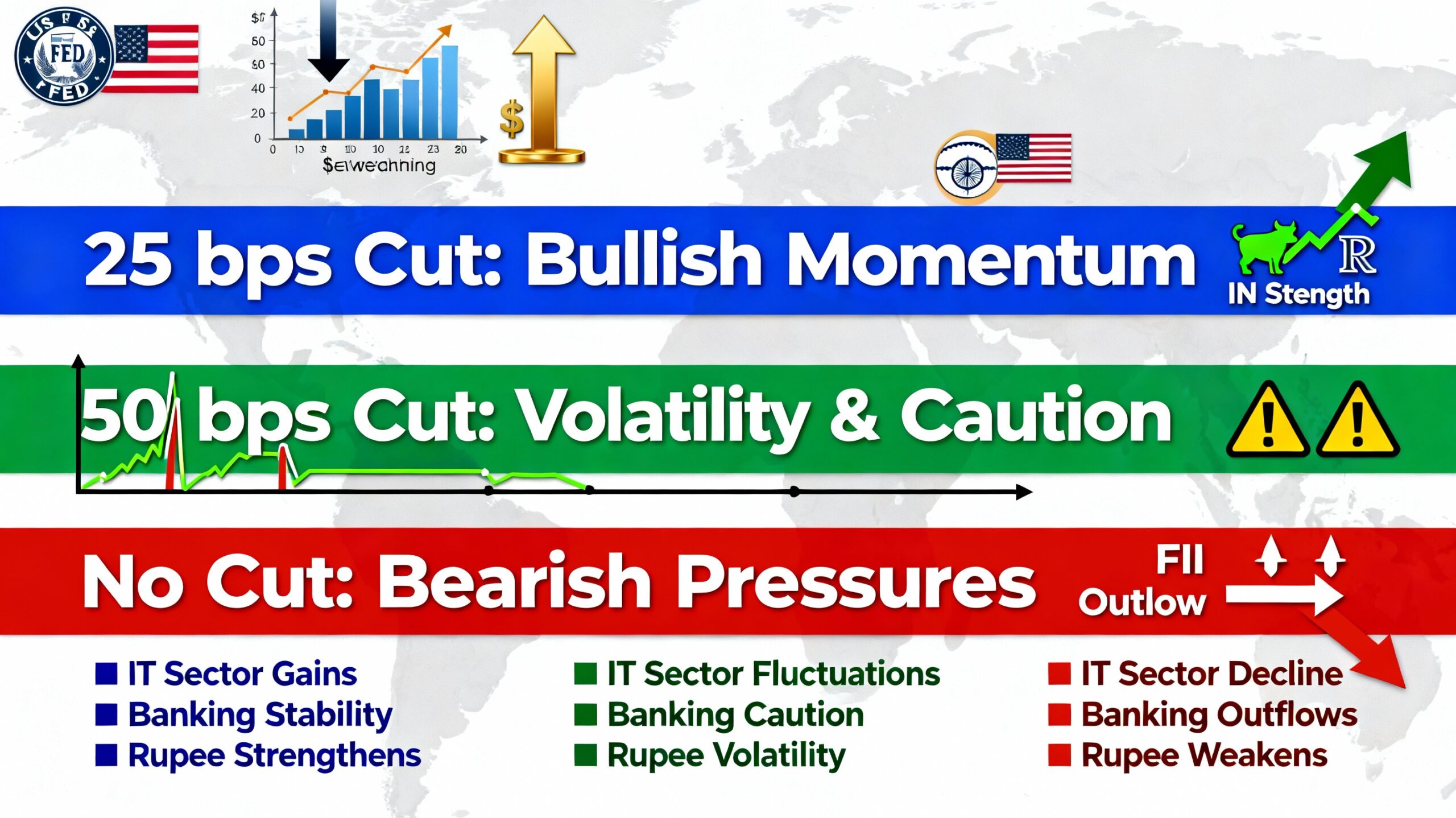

Scenario 1: 25 bps Rate Cut

A 25 basis point cut is largely anticipated and already priced in by most traders. In this case, Indian equities could see a short-term relief rally, led by sectors such as banking, financials, and cyclical stocks. However, the tone of Jerome Powell’s commentary will determine whether the optimism lasts.

If the Fed signals confidence in the economic outlook, risk appetite could remain healthy, spurring foreign inflows and strengthening sectors sensitive to global liquidity like IT and real estate. A softer U.S. dollar could also support gold, silver, and emerging market currencies like the INR.

Scenario 2: 50 bps Rate Cut

A half-percentage-point cut might initially trigger a strong rally, but it could also raise questions about whether the Fed is responding to deeper economic stress. Such an aggressive cut would push U.S. bond yields lower, weaken the dollar, and lift prices of precious metals. Indian markets might witness high volatility—strong early gains followed by profit booking as investors assess the Fed’s rationale.

Scenario 3: No Rate Cut (Status Quo)

If the Fed maintains current rates, markets could react negatively in the short term. A pause may be interpreted as a sign of caution, leading to FII outflows and weakness in high-beta or globally linked sectors. Defensive and domestic-focused stocks such as FMCG, healthcare, or utilities may outperform in this case. Additionally, the dollar could strengthen, putting mild pressure on the rupee and Indian equities.

Why the Fed’s Move Matters for India

The Federal Reserve’s actions influence global liquidity and investor sentiment across emerging markets. A lower U.S. interest rate generally pushes investors toward higher-yielding markets like India, benefiting equities, especially in IT, banking, and financial sectors. However, this time, the focus will be as much on Powell’s tone and forward guidance as on the actual rate cut.

Even a small shift in the Fed’s communication—from “hawkish” to “dovish”—can reset global risk sentiment and drive large fund flows across markets.