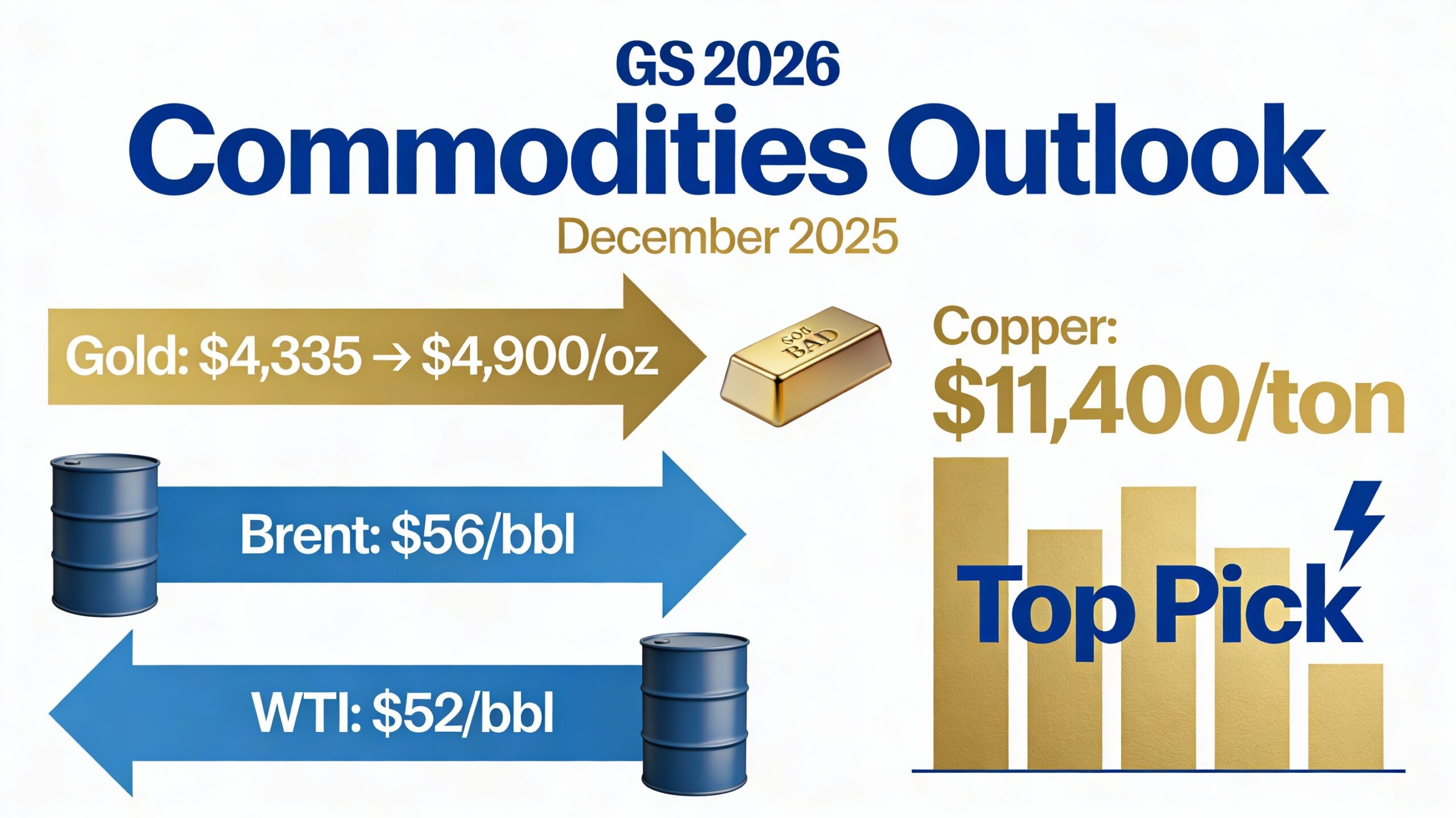

Goldman Sachs Sees Gold Surging to $4,900 by December 2026; Oil Prices Projected to Drop, Copper Still a Long-Term Favorite

Goldman Sachs has forecasted that gold prices could soar to $4,900 per ounce by December 2026, representing roughly a 14% increase from current levels. The bank attributes this anticipated rise to strong central bank demand and supportive monetary policies, including potential interest rate cuts by the U.S. Federal Reserve. The firm also highlights the possibility of even higher prices if private investors expand diversification into gold.

As of Thursday’s trading, spot gold stood at $4,334.93 per ounce.

Turning to base metals, copper remains Goldman’s “favorite” industrial metal despite expectations of price consolidation in 2026. The bank expects copper to average $11,400 per metric ton next year, affected by uncertainty over U.S. tariff policy. Still, long-term fundamentals look strong as electrification drives nearly half of global copper demand, while mine supply continues to face constraints. Copper prices recently peaked at a record $11,952 per metric ton, with the current rate around $11,721.50.

On the energy side, Goldman projects lower oil prices in 2026, forecasting averages of $56 per barrel for Brent crude and $52 per barrel for WTI. The bank expects this decline to help rebalance global supply and demand, provided no major disruptions occur. It anticipates oil prices bottoming out around mid-2026 before gradually recovering toward $80 (Brent) and $76 (WTI) per barrel by late 2028, as markets begin pricing in future supply shortages.

For natural gas, Goldman expects European Title Transfer Facility (TTF) prices at €29/MWh in 2026 and €20/MWh in 2027, aiming to spur additional demand. In the U.S., gas prices are projected at $4.60/mmBtu (2026) and $3.80/mmBtu (2027) to encourage production growth.

The bank also warns that U.S. power markets could face pressure due to surging electricity demand, mainly from the data center industry, coupled with coal plant retirements. According to their analysis, 72% of U.S. data centers are concentrated in just 1% of counties, raising concerns about local grid reliability and potential outages.