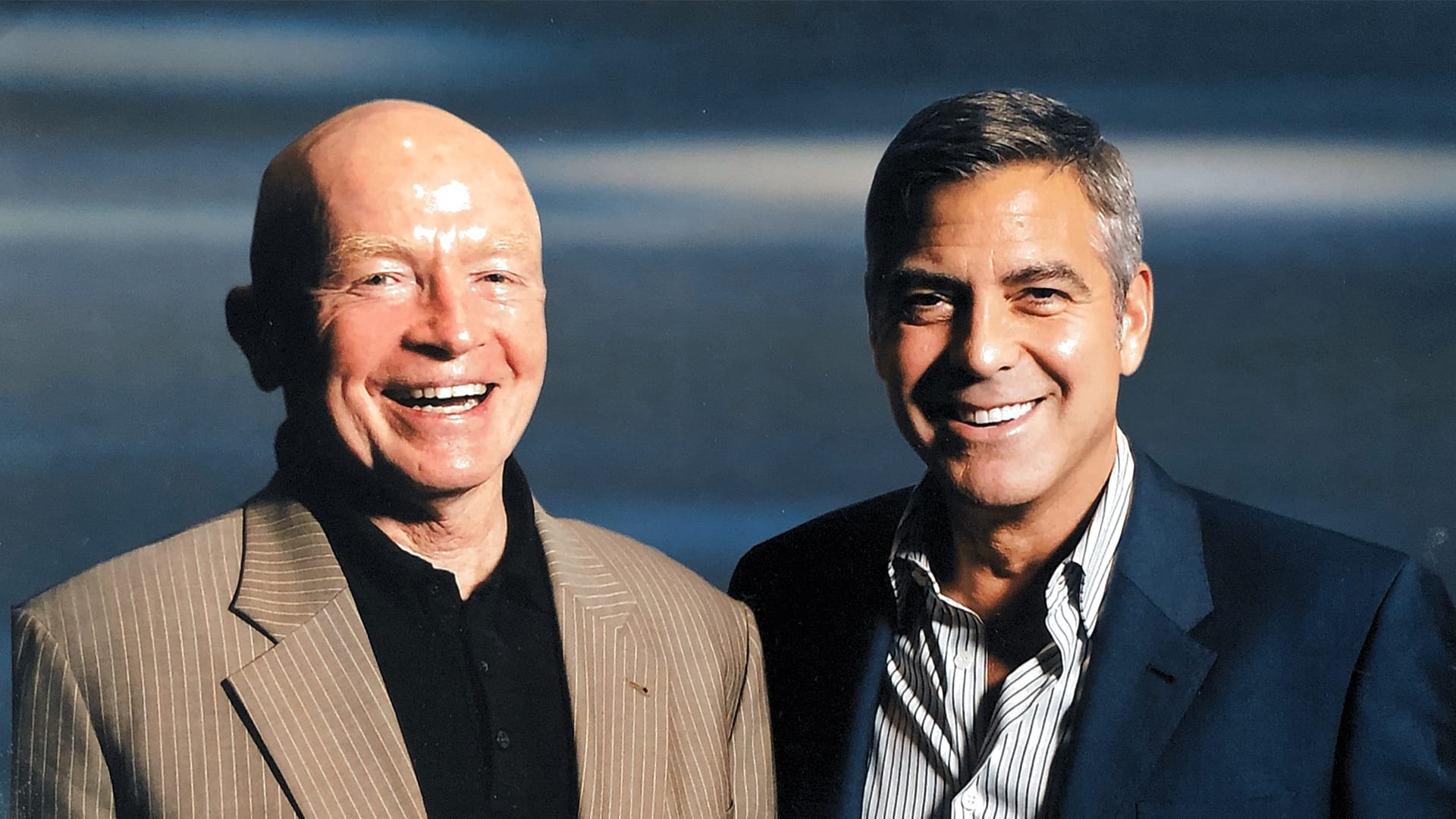

In an exclusive interview with Moneycontrol, the renowned global investment guru Mark Mobius expressed his belief that the recent credit downgrade of the United States will compel investors to diversify their portfolios into other markets.

Mark Mobius has an extensive background in the Indian markets, having previously led the Templeton Emerging Market Group for over three decades before establishing his own investment company, Mobius Capital Partners, in March 2018. Throughout his career, he has been a strong advocate of investing in emerging markets, particularly in India.

During this exclusive interview, Mobius discussed how the credit downgrade of the US will prompt investors to seek diversification opportunities in international and emerging markets, with a specific focus on India. Additionally, he shared his insights on India’s growth, foreign investments, and the risk perceptions of foreign investors looking to invest in the country.

1. Diversification: A Necessity for Investors

Mobius emphasized that the credit rating downgrade of the US signifies the need for global investors to diversify their holdings beyond the American market. While he doesn’t recommend reducing exposure to the US market entirely, he advocates considering diversification as assets increase. He suggests allocating more resources into international markets, particularly in emerging markets like India. This strategy would help investors avoid relying too heavily on the US market and spread their risks across various regions.

2. The Dollar Safe-Haven Trade in Question

Traditionally, during global economic uncertainties, the US dollar has been considered a safe-haven currency. However, Mobius pointed out that the US dollar index has been on a downward trend, showing an 18 percent decrease since the previous year. This decline indicates the rise of stronger alternative currencies, such as the Euro and other currencies, which could potentially erode the dollar’s safe-haven status. As a result, investors may consider diversifying into other currencies, including some emerging market currencies, which have shown resilience against the US dollar.

3. Impact on Investing in India

Foreign investors who consider investing in India have long factored in a depreciation of 3 to 6 percent in the Indian rupee. However, Mobius suggested that this assumption might change in the future. Many Indian companies export their goods in US dollars and other foreign currencies, offsetting the impact of a weakening rupee. Consequently, a weaker rupee can actually improve the margins for these businesses, making them attractive for equity investments.

4. Bridging the Divergence Between US and Indian Markets

Regarding the current divergence in performance between the US and Indian markets, with the former outperforming the latter, Mobius believes that the situation will change. He anticipates an increase in investments flowing into India and other emerging markets, potentially closing the performance gap between the two markets.

5. Foreign Portfolio Flows to India

When asked about the potential impact of a recovery in China on foreign portfolio flows to India, Mobius acknowledged that China might take time to regain foreign investors’ confidence due to past negative experiences. However, he highlighted that the Chinese market is primarily driven by local investors. Once Chinese consumers regain confidence, the market could witness increased foreign investments. Mobius predicts this shift to occur towards the end of the current year or the beginning of the next.

6. India’s Growing Appeal to Global Investors

Mobius remains optimistic about the future inflow of investments into India. The Indian government, along with state governments, actively promotes investment and fosters a conducive environment for global investors. As India’s growth story becomes more widely recognized and the Indian rupee becomes more internationalized, foreign investors are expected to increase their allocations to the country.

7. The Challenge of Market Size for India

Despite the positive outlook for India, Mobius acknowledged that one of the challenges the country faces is its relative market size. When dealing with large institutional clients in America or Europe, they often compare the Indian market’s size to that of China and may be cautious in their investments. Mobius emphasized the importance of increasing the privatization of state-owned enterprises to expand the Indian market’s size and attract more significant investments.

8. Currency Concerns

Among investors, the most significant concern regarding India is the depreciation of its currency and the potential impact on investments. The volatility of the Indian rupee raises worries among investors. While this concern exists for India, Mobius stated that it is not unique to the country and is shared by other nations as well.

Conclusion

Mark Mobius’s insights provide valuable guidance for investors navigating the current global economic landscape. His views on diversification, currency considerations, and the appeal of emerging markets like India offer valuable perspectives for those seeking to optimize their investment strategies. As markets continue to evolve, the potential for India to become a preferred investment destination grows, driven by its growth story and favorable economic outlook. Nonetheless, investors must remain attentive to global dynamics and consider diversifying their portfolios to mitigate risks and capitalize on emerging opportunities.